Cash Loans: Comparing Lenders

The Benefits of Finding Installation Loans for Your Following Major Purchase

When thinking about a significant acquisition, lots of people forget the advantages of installation car loans. These loans provide foreseeable regular monthly payments that can improve budgeting. They usually include reduced rate of interest than charge card, which can reduce monetary strain. Additionally, consumers can appreciate clear financing conditions. Nevertheless, the benefits prolong beyond mere numbers. Exploring these facets can expose just how installment lendings might function as a calculated economic device.

Predictable Month-to-month Repayments

They benefit from foreseeable monthly settlements that streamline budgeting when consumers select installment fundings for major acquisitions - Cash Loans. This structured repayment approach enables individuals to designate their funds successfully, guaranteeing that they can fulfill their lending commitments without the tension of varying costs. Each month, borrowers recognize specifically just how much they need to reserve, decreasing the danger of overspending and advertising accountable economic behaviors

Additionally, predictable settlements promote long-term planning. Customers can review their monthly costs, including the finance repayment, and adjust their spending plans appropriately. This quality can cause a more self-displined strategy to conserving and spending, ultimately adding to better monetary health and wellness. With installment lendings, the assurance of taken care of monthly payments minimizes stress and anxiety regarding unforeseen costs, allowing consumers to concentrate on their acquisitions rather than economic unpredictabilities. Consequently, installation financings provide a practical solution for taking care of substantial expenses while maintaining financial duty.

Lower Passion Rates Compared to Credit Rating Cards

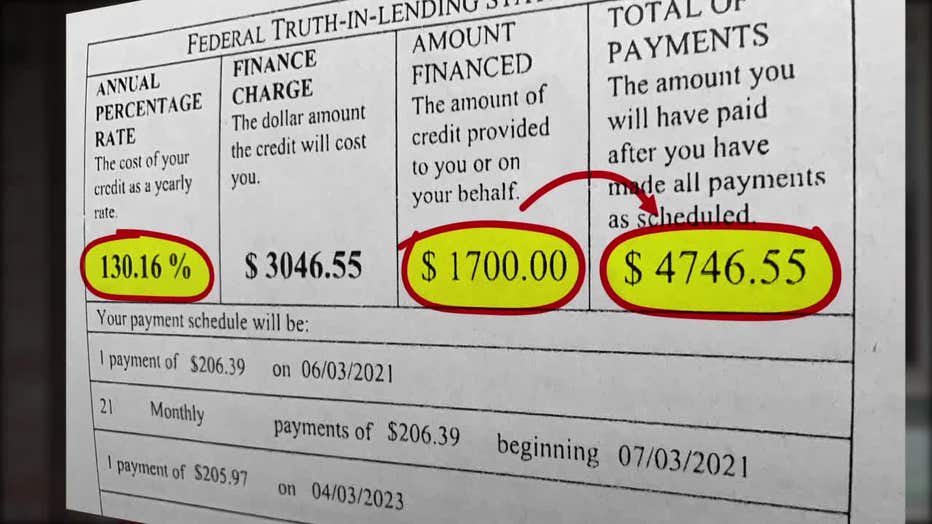

Installment finances frequently include reduced passion rates contrasted to charge card, making them an economically smart alternative for major purchases. Bank card commonly carry higher yearly percentage prices (APRs), which can result in substantial rate of interest costs if balances are not repaid rapidly. On the other hand, installation finances frequently supply consumers with fixed rates, enabling for foreseeable repayment terms over a specified duration. This can result in considerable financial savings, particularly for high-ticket items like cars or home devices. Additionally, the reduced rate of interest related to installation fundings can lessen the total economic burden, making it possible for customers to manage their budget plans much more properly. This makes installation lendings an appealing choice for individuals looking to make significant acquisitions without incurring extreme financial debt. By picking an installment funding, consumers can protect a much more positive financial outcome while all at once taking pleasure in the benefit of spreading payments with time.

Clear Financing Conditions

Understanding the clear financing terms and conditions can substantially improve a borrower's monetary decision-making procedure. Installment finances commonly offer simple repayment routines, repaired rate of interest, and clear charges, which can make it simpler for customers to comprehend their obligations. This clarity allows individuals to analyze their capability to pay back the car loan without the confusion frequently connected with variable-rate credit score products.

Clear terms assist borrowers stay clear of potential challenges, such as concealed charges or unexpected rises in regular monthly settlements. By understanding specifically what to expect, consumers can make educated selections about their economic dedications. In addition, comprehending the car loan conditions cultivates greater trust fund between lending institutions and consumers, as distinct agreements reduce the chance of disputes. Finally, clear lending terms and conditions empower debtors, allowing them to browse the borrowing process with confidence and assurance.

Improved Budgeting and Financial Preparation

Installation lendings use customers foreseeable monthly settlements, which can greatly improve budgeting efforts. This economic predictability permits better cash money circulation administration, making it possible for people to assign resources a lot more properly. Consequently, customers can prepare for both instant costs and future economic objectives with better confidence.

Foreseeable Regular Monthly Settlements

They commonly discover that predictable regular monthly payments significantly enhance their budgeting and financial preparation initiatives when individuals choose for installment car loans. This structure allows consumers to allot a specific amount of their income every month in the direction of funding repayment, lessening the risk of unexpected monetary strain. By understanding the precise settlement due day and quantity, individuals can plan their expenditures much more efficiently, guaranteeing that they can meet both their car loan obligations and other economic commitments. This predictability can result in boosted savings practices, as people are much less most likely to overspend when they have a clear understanding of their regular monthly monetary landscape. Generally, predictable settlements promote a feeling of control and confidence in taking care of funds, making installment car loans an enticing choice for major purchases.

Boosted Cash Flow Monitoring

Effective cash money flow monitoring plays a crucial duty in improving budgeting and economic preparation for people tackling installment lendings. By breaking down the overall price of an acquisition right into workable regular monthly repayments, debtors can designate their income better. This organized technique continue reading this permits people to prepare their expenses, ensuring they have enough funds for both dealt with and variable costs monthly. Furthermore, recognizing the specific settlement amount makes it simpler to expect future monetary commitments, lowering the possibility of overspending. With enhanced cash money circulation monitoring, consumers can keep a well balanced budget plan, avoid late costs, and eventually work toward their economic objectives with higher confidence. This clarity adds to an extra steady financial future and promotes responsible costs practices.

Quick Accessibility to Funds

Many consumers appreciate the benefit of fast accessibility to funds when making considerable purchases. Installment loans offer a streamlined procedure that allows people to protect financing swiftly, frequently within a few days. This prompt authorization can be specifically helpful for those facing unexpected expenditures or possibilities that call for immediate financial sources, such as purchasing a new automobile or home repair work.

Unlike typical car loans, which may include extensive application processes and substantial documents, installation loans typically require marginal documents. This ease of access not only eases the stress related to immediate economic demands yet also makes it possible for consumers to act promptly in open markets. In addition, the simplicity of online applications boosts the speed of acquiring funds, enabling consumers to get essential capital without hold-up. To sum up, the fast accessibility of funds with installation financings empowers customers to make prompt decisions pertaining to considerable acquisitions.

Adaptability in Car Loan Amounts

Customized Funding Solutions

While major acquisitions frequently need considerable monetary commitment, tailored funding remedies give borrowers with the capacity to protect funds that straighten with their certain needs. These solutions allow individuals to pick loan quantities that match to their acquiring power and economic circumstance. By providing a variety of choices, loan providers can accommodate various budgets, ensuring that customers are not pushed into a one-size-fits-all scenario. Borrowers can assess their financial capabilities and pick a loan quantity that lessens anxiety while taking full advantage of purchasing potential. This adaptability empowers them to make enlightened choices, ultimately enhancing their total monetary health and wellbeing. Tailored lending solutions attract attention as a functional choice, permitting even more manageable monetary planning and a smoother investing in experience.

Flexible Layaway Plan

Adjustable settlement plans provide borrowers the possibility to tailor their repayment framework according to their economic situations. This adaptability allows people to select finance quantities and repayment routines that line up with their income and monetary needs. Customers might pick to make smaller repayments over a longer period or bigger payments in a shorter duration, depending on their preferences. This flexibility can significantly alleviate monetary stress and anxiety, enabling debtors to handle their monthly expenses extra successfully. Flexible payment plans can fit life modifications, such as task shifts or unexpected expenses, permitting consumers to adjust their payments as needed. In general, this feature enhances the overall ease of access and appearance of installation loans for major purchases.

Diverse Financing Options

Several installment loans provide varied financing choices, enabling debtors to select funding amounts that best suit their specific demands. This adaptability is specifically valuable for people making considerable purchases, such as cars or home renovations. By offering numerous financing quantities, loan providers enable borrowers to prevent taking on unneeded financial debt while guaranteeing they can protect the necessary funds. In addition, debtors can tailor their loans to match their monetary capabilities, lowering the risk of default. This adaptability additionally motivates accountable loaning, as people can pick amounts that straighten with their useful reference budgets and payment strategies. Consequently, varied funding options empower right here customers to make informed economic decisions, enhancing their total getting experience.

Opportunity to Develop Credit Report

Constructing a robust credit report is a substantial benefit of utilizing installment financings for major purchases. By obtaining an installment funding, consumers have the opportunity to show their credit reliability via regular, on-time settlements. This consistent repayment behavior favorably impacts credit rating, which are essential for future economic endeavors.

Unlike rotating credit score, such as credit cards, installment car loans have actually repaired repayment routines, making it easier for borrowers to handle their funds and assurance timely payments. Each effective repayment not only builds credit rating however likewise boosts trust fund with future lending institutions.

Furthermore, a solid credit report can lead to much better interest rates and financing terms in the future, offering more financial advantages - Fast Cash. For individuals wanting to make substantial acquisitions, such as a home or automobile, establishing a strong debt structure via installment loans can be a strategic economic action, paving the way for even more significant loaning opportunities down the line

Often Asked Concerns

What Sorts of Purchases Are Best Matched for Installment Loans?

Large acquisitions such as automobiles, home improvements, and costly home appliances are best matched for installment finances. These items typically need substantial financial investment, making manageable regular monthly repayments extra enticing and financially feasible for consumers.

Exactly how Lengthy Does the Authorization Refine Commonly Take?

The approval procedure for installment loans generally takes anywhere from a few mins to numerous days, depending upon the lending institution's demands, the candidate's creditworthiness, and the complexity of the economic info provided throughout the application.

:max_bytes(150000):strip_icc()/installment-loans-315559_FINAL-34e8393b3e624a31b96a285b270956bf.png)

Can I Pay off an Installment Finance Early Without Penalties?

Lots of lending institutions enable early repayment of installment car loans without penalties, yet specific terms differ. Borrowers must assess their financing contracts or consult their lenders to understand any type of potential fees related to early reward.

What Takes place if I Miss a Settlement?

Missing a settlement on an installment financing might result in late charges, boosted rate of interest prices, and prospective damage to credit history. Lenders might likewise start collection actions, influencing future loaning possibilities for the debtor.

Exist Any Kind Of Covert Fees With Installment Loans?

Concealed charges can occasionally come with installment car loans, including source charges, late payment charges, or early repayment charges. Debtors ought to completely assess lending agreements and ask loan providers regarding any kind of possible prices prior to dedicating to a car loan.

With installment lendings, the certainty of dealt with month-to-month repayments reduces stress and anxiety about unexpected prices, enabling customers to concentrate on their acquisitions instead than economic uncertainties. When individuals decide for installation loans, they commonly find that foreseeable month-to-month repayments considerably enhance their budgeting and monetary planning initiatives. Unlike typical fundings, which may include prolonged application procedures and extensive documents, installment finances normally require minimal documents. Flexibility in loan quantities is an important function of installment loans, allowing debtors to discover tailored solutions that satisfy their particular economic requirements. Several installment finances give diverse financing options, allowing customers to pick loan amounts that finest match their specific demands.